Exploring Dubai Real Estate Market 2024: Trends, Opportunities, and Challenges

As we step into 2024, let’s explore the Dubai Real Estate Market. This comprehensive examination unveils current market dynamics, future forecasts, and lucrative opportunities for investors.

Backed by factual data and statistics, we’ll uncover insights while providing an insider’s view of key players in the real estate landscape, offering a clearer understanding of the market conditions and potential pathways for success.

Additionally, we’ll shine a spotlight on Mayfair Properties, explaining our pivotal role in navigating and seizing opportunities within Dubai’s real estate sphere.

Current Real Estate Market Overview in the UAE

What’s happening in the property market of the United Arab Emirates?

Right now, the United Arab Emirates is incredibly stable, which is a big deal when it comes to investing in real estate. Stability is key for long-term growth and making profits, especially for foreigners thinking of buying property here.

The UAE is well-known for being super stable. In fact, it scored an exceptional 39.1 on the recent Fragile State Index, showcasing its rock-solid stability.

Thanks to its huge oil reserves, the UAE’s economy is strong. The government has put a lot of money into building things like roads and schools, making the country prosperous and secure. Plus, its friendly relationships with neighboring countries add to its safety and peace.

It’s a safe place to invest in. Now, let’s take a closer look at what’s coming up economically.

When you’re thinking about real estate, keep two things in mind:

- More people means a higher demand for homes.

- When people have more money, they’re likely to spend more on housing, potentially driving up property prices.

In the last 5 years, the average amount of money each person has gone up by 3.8% in the UAE. It’s not a huge increase, but it’s moving upward. And the number of Emirati people has grown by 8% in the same time.

What does this mean? Imagine you buy a really nice house in Dubai and decide to rent it out. Each year, there might be more people who can afford to rent it.

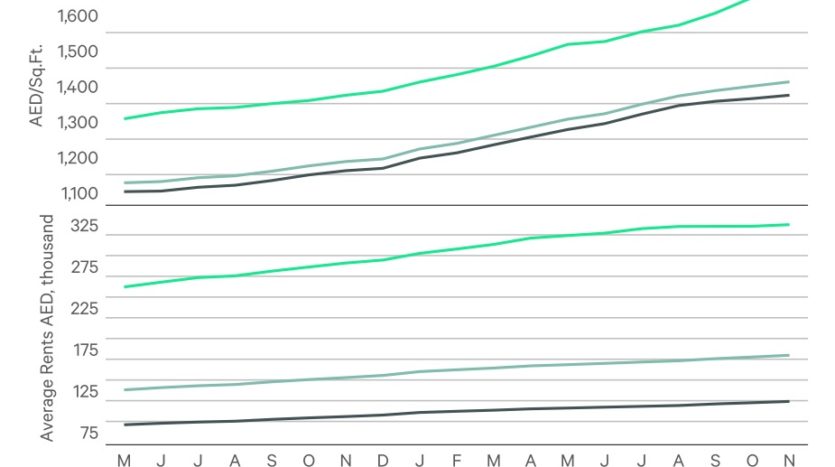

Dubai Residential Real Estate Market Snapshot December 2023

| Key Highlights | November 2023 | Year to Date (up to December 26th, 2023) |

| Residential Transactions in Dubai | 9,034 (-13.2%) | 112,356 (Record High) |

| Average Price Growth | 18.9% | – |

| – Apartments | 18.3% | – |

| – Villas | 22.2% | – |

| Residential Rent Growth | 19.2% | – |

| – Apartments | 19.6% | – |

| – Villas | 16.6% | – |

This updated table now reflects the figures until December 26th, 2023, providing a comprehensive view of the residential real estate market in Dubai for both November and year-to-date statistics.

Source: CBRE

Dubai Real Estate Market: What’s Next for Prices?

The forecast for Dubai’s real estate market indicates a probable slowdown in the coming year, with prices expected to ease, as per a recent report.

S&P Global’s report suggests the sector may grow by 5% – 7% next year. Analysts Tatjana Lescova and Sapna Jagtiani foresee a potential deceleration in price increases and a slight reversal within the next 12-18 months, possibly leading to declines not exceeding 5-10%.

While villa prices have surged beyond previous peak levels, apartments lag at 10-20% below these peaks due to a past oversupply, according to the report.

Several factors contribute to Dubai’s robust property market. Foreign investors, particularly high net worth individuals, sustain strong demand, especially for prime properties. Despite global economic sluggishness, Dubai has shown remarkable immunity. Its diverse economy, despite higher corporate funding costs and lingering inflation below the global average, has performed well.

Anticipating a relatively strong economic growth of 3% in 2023-2024 following a post-pandemic recovery averaging 5% in 2021-2022, analysts foresee improved fiscal strength for Dubai’s government. They also anticipate a decline in its debt burden relative to GDP, unlike more heavily indebted economies facing longer periods of high interest rates.

S&P predicts continued growth in hospitality, wholesale and retail, and financial services, while real estate might undergo a slowdown in the next 12-18 months post a strong 2023.

Dubai’s population has grown over 2% to 3.6 million (September 2023 data), and international visitors are steadily rebounding. With Dubai International Airport surpassing 2019 passenger numbers, aiming for 17 million yearly visitors within three years, the city shows recovery in tourism.

Dubai Real Estate Analysis for 2024

-

Anticipated Rise in Interest Rates

The impact of higher interest rates on Dubai’s real estate market is expected to differ, experts suggest. Variable-rate mortgages in the UK typically last two years, while in the US, mortgages tend to have longer fixed periods.

Despite the uncertainty around rising interest rates in the UAE, analysts remain confident that Dubai’s real estate market will continue its robust growth from 2023. Moreover, a shortage of affordable housing will persist, driving rents up and contributing to an overall higher cost of living.

Source: Sands of Wealth

-

UAE’s Economic Outlook

The UAE’s economy is forecasted to grow by 2.5 percent this year and two percent in 2024, according to S&P Global. The population is expected to increase by an average of two percent annually. In the past year, Dubai’s real estate market thrived, witnessing a remarkable over 60 percent surge in prices. In Abu Dhabi, average prices escalated by six percent.

-

Forecasted House Price Inflation

Following a robust quarter, Dubai’s real estate market is now showing signs of slowing down. While the city will continue experiencing price hikes in the coming years, these increases are projected to decrease significantly, reaching 4.5% and 3.0% in 2023 and 2024 respectively. Nonetheless, stability in the market is expected, offering investors a reliable hedge against inflation.

-

Global Property Market and Inflation

Recent studies indicate a cooling trend in the global property market, with expectations of a decline in house prices. The anticipated rise in interest rates is likely to moderate the substantial price surges of recent years. However, this decline may not substantially enhance housing affordability for the middle-class due to escalating costs of consumer goods, loans, and fuel, potentially pressuring them to sell their properties.

-

The UAE’s Growth Prospects

It’s crucial to gauge the country’s economic health before making property investments. As per IMF projections, the UAE is set to conclude 2023 with a growth rate of 3.5%, signaling a positive trajectory. The consensus estimate for 2024 stands at 3.9%. The projected sustained growth, with an estimated 17.6% growth over the next 5 years and an average GDP growth rate of 3.5%, presents a promising opportunity for real estate appreciation and long-term investment stability.

-

Moderate Inflationary Impact in the UAE

Inflation affects the overall cost of living, potentially influencing various aspects, including property investments. Higher inflation can offer certain advantages:

- Property values tend to appreciate over time.

- Rental rates might increase, boosting property cash flow.

- Inflation reduces the real value of debt, making mortgage payments more manageable.

- Real estate acts as a hedge against inflation, preserving investment value.

Diversifying into real estate during inflationary periods provides stability. The IMF’s outlook suggests an anticipated 10.8% inflation over the next 5 years, averaging a yearly increase of 2.2%. This data indicates a potential inflationary trend in the UAE, hinting at rising prices in the future. Buying property now could prove advantageous as your investment might appreciate, potentially yielding higher returns in the future

Bottom Line

In Dubai’s evolving real estate scene for 2024, growth is expected but with changing dynamics. With projected property price hikes of 20-25%, demand remains high.

Mayfair Properties, with their seasoned experts, guide investors through these shifts, aiding in smart investment decisions or property sales. Their insight into Dubai’s market nuances ensures informed choices amidst changing trends.

As experts in UAE real estate, Mayfair offers tailored solutions, empowering clients to seize emerging opportunities and navigate market fluctuations. Whether capitalizing on growth or adapting to market shifts, Mayfair Properties stands as a reliable partner in Dubai’s dynamic real estate landscape.